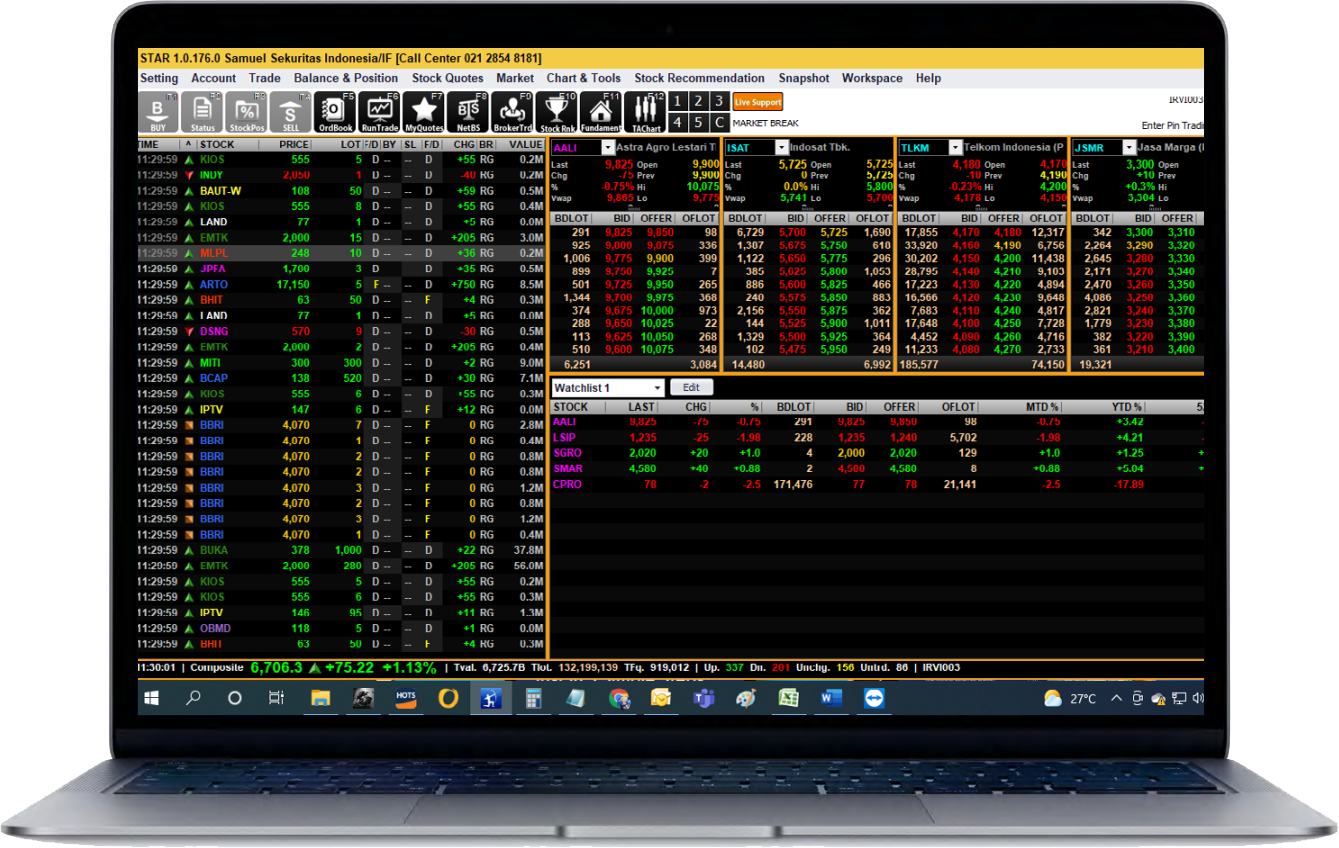

Samuel Sekuritas Indonesia is a leading Indonesian securities brokerage firm. Established in 1997, the firm has grown to become one of the most respected and trusted financial services companies in the country. With a wide range of services and products, Samuel Sekuritas Indonesia has become a trusted partner to many investors, both institutional and individual.

The company offers a variety of financial services, including equity, debt and derivative securities brokerage services, research and portfolio management, asset management and capital market services, as well as a range of other investment solutions. Samuel Sekuritas Indonesia is also a leader in providing financial education and training, and has established itself as a leading provider of investor relations services.

The company has a strong research capability and is committed to providing its clients with up-to-date and reliable market analysis and recommendations. It also has a team of experienced and knowledgeable professionals who are dedicated to providing quality service to its clients. As a result, Samuel Sekuritas Indonesia has become a preferred partner for many investors in Indonesia.

In addition to its financial services, Samuel Sekuritas Indonesia also offers a range of other services, such as corporate finance and advisory services, mergers and acquisitions, and venture capital.